How to Become Financially Independent in 5 Simple Steps

If you’re wondering how to become financially independent, you’re in the right place. Taking control of your financial future and achieving true financial freedom is something anyone can have.

From setting financial goals to creating a budget, paying off debt, investing for the future, and diversifying your income sources, we will cover everything you need to know to secure your financial freedom.

In this article, we will break down the process of how to become financially independent in 5 simple steps that will help you reach your goals.

What Is Financial Independence?

Financial independence refers to the state in which an individual has enough savings, investments, and passive income to sustain their desired lifestyle without being reliant on employment or traditional income sources.

Achieving financial independence is significant in personal finance as it provides individuals with a sense of security and flexibility in their financial decisions.

You’ll understand that if you’ve ever been financially strapped.

Effective money management, developing a strategic budget, saving diligently, investing wisely, and reducing debt all play a crucial role in this journey, helping individuals build and grow their wealth over time.

Prioritizing financial well-being is essential for long-term success, as it allows individuals to enjoy a life free from financial stress and uncertainty.

Makes sense and we’ll cover the ‘how’ in a minute with the 5 simple steps.

Why Is Financial Independence Important?

Financial independence is important to most people because it allows you to build wealth, plan for and enjoy retirement, achieve financial stability, and ultimately give you the option of giving back.

Having financial independence provides a sense of security and freedom, enabling you to make confident decisions about your money without relying on others. This autonomy can lead to a more relaxed retirement, whether that’s in your golden years or as a young entrepreneur.

It empowers you to invest wisely, manage financial risks, and take advantage of opportunities to grow your wealth over time, providing for yourself and your family to have a more stable and prosperous life.

Step 1: Set Financial Goals

Setting financial goals is the foundation for achieving financial independence, requiring a mindset focused on growth and dedication to the journey of financial independence.

If you don’t know where you’re going, you’ll never get there.

What Are the Different Types of Financial Goals?

Financial goals include various aspects such as saving for retirement, building an emergency fund, investing for growth, and giving back.

Saving for retirement is a vital financial goal that many individuals prioritize to ensure a comfortable and secure future.

You don’t want to have to work your entire life if you don’t want to.

Similarly, setting up an emergency fund acts as a safety net during unforeseen circumstances, providing financial stability in times of need.

No matter who you are, you’ll have an emergency at one point or another in your life. We all do.

Investing to achieve growth is another key objective for individuals to multiply their wealth and work towards financial freedom.

Having enough to give back is another worthy financial goal.

Ask almost any successful person and they will say giving was part of what made them successful.

How to Set Achievable Financial Goals?

Setting achievable financial goals involves creating specific, measurable, attainable, relevant, and time-bound targets aligned with your financial desires to track progress effectively.

By following the SMART criteria individuals can enhance their financial well-being ensuring goals are:

- Specific in defining what needs to be achieved

- Measurable to track progress

- Achievable within your means

- Relevant to your larger financial goals, and

- Time-bound with clear deadlines

To work towards financial independence, it’s really important to save consistently, reduce unnecessary expenses, invest wisely, and increase income streams.

Then regularly monitor your financial goals and adjust as needed to stay on track with your goals.

Step 2: Create a Budget and Stick to It

Creating a budget and sticking to it is an important step in creating financial abundance. Some might say it’s vital.

What Is a Budget and Why Is It Important?

A budget is a financial plan that outlines income, expenses, and savings. Its purpose is to help keep you on course to meet your financial goals through good habits and the right mindset.

Knowing where money is coming from and where it is going, you can make better spending and saving decisions.

When consistently practiced, budgeting helps create the right mindset centered around financial growth for a more stable and abundant financial future.

How to Create a Realistic Budget?

It’s helpful to categorize expenses into different groups such as fixed expenses like rent or mortgage payments, utilities, and variable expenses like groceries, entertainment, and dining out.

By clearly tracking these expenses, you get an overview of where your money is going each month.

One tool I like using to help me budget is Everydollar.com. It’s free and user-friendly.

Step 3: Pay off Debt

Why Is It Important to Pay off Debt?

Debt will only hold you back from your financial goals. Paying it off is important to building financial abundance and having financial freedom.

By eliminating debt, you free up your financial resources, allowing you to invest in wealth-building assets and pursue long-term financial growth.

The positive impact of getting rid of debt goes far beyond just financial stability. It increases peace of mind and a sense of accomplishment.

How to Prioritize and Pay off Debt?

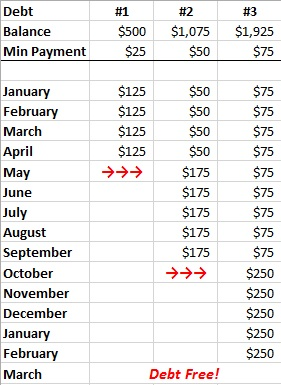

One of the best and most effective ways to pay off debt is by using the debt snowball method.

The debt snowball method speeds up the process of paying off debts.

You put each of your debts in columns in Excel or Google Sheets with their minimum payments. Also, put each month listed down the first column.

Make sure you start with the most crucial debt first. For example, one that has the highest interest or one that is in collections.

Then put as much toward that debt each month as you can while still paying the minimum payments for the other debts.

As soon as that debt is paid off in full, add that amount toward the next debt on your sheet compounding the payments.

And as soon as the second debt is paid in full, add that amount toward the next debt until each of your debts are paid off and you are debt free.

Being in debt limits the choices you can make with regards to your money, so getting out of debt is totally worth it.

Step 4: Invest for the Future

Why Should You Invest for the Future?

Investing for the future is important to accelerate progress towards financial independence, abundance and freedom.

By strategically investing your money, you can grow your wealth exponentially over time.

Investing not only provides a sense of financial security but also opens up opportunities for diversification and passive income for future generations.

Investments serve as a vehicle for individuals to meet significant milestones such as buying a home, funding education, or retiring comfortably.

In short, investing lays a solid foundation for a prosperous and secure financial future when done right.

What Are the Different Types of Investments?

Various investment options include stocks, bonds, real estate, and mutual funds.

Each offers unique strategies to support financial independence and wealth building.

Stocks have historically offered growth potential, while bonds provide stability through fixed income.

Real estate investments can generate passive income through rental properties, and mutual funds offer diversification across asset classes.

When selecting investments, it’s important to align them with your financial goals and risk tolerance.

Things to consider are your time horizon, desired returns, and level of involvement in managing the investments.

Researching market trends and seeking professional advice can also help in making informed decisions that contribute to wealth accumulation and financial abundance.

Step 5: Diversify Your Income Streams

Why Is Diversifying Your Income Important?

Creating multiple streams of income is key in developing financial independence.

Diversifying income streams is a great way to build passive income streams, which helps you build more long-term financial freedom.

When you spread your income across different channels, you not only reduce financial risks but also open doors to various opportunities for wealth creation.

Adopting the mindset of creating and building multiple streams of income can lead to greater financial independence in the long run.

How to Diversify Your Income Streams?

One of the best ways to create multiple streams of income is to start one or more side hustles.

There are many different types of side hustles you could start or develop to add more income streams.

Here are 5 examples of different income streams:

- Affiliate Marketing

- Start a Blog

- Sell Digital Products

- Sell Services

- Teach Online Courses

For more ideas and information on how to start a side hustle, check out my article How to Create Multiple Streams of Income.

Frequently Asked Questions

What does it mean to become financially independent?

Financial independence means having enough money and resources to support yourself and your lifestyle without relying on others for financial support.

It allows you to have control over your finances and the freedom to make choices that align with your goals and values.

What are the 5 simple steps to becoming financially independent?

The 5 simple steps to becoming financially independent include setting financial goals, creating a budget, paying off debt, saving and investing, and continuously educating yourself about personal finance.

How do I set financial goals?

Start by identifying your long-term and short-term financial goals, such as buying a house or retiring early. Then, break them down into bitesize, achievable goals and create a plan to reach them.

Why is creating a budget important for financial independence?

A budget is your success blueprint that helps you track your income and expenses, allowing you to see where your money is going and make adjustments to save and invest more. It also helps you prioritize your spending and avoid overspending.

What is the best way to pay off debt?

The best way to pay off debt is to use the debt snowball method. Focus on paying off the debt with the lowest balance while making minimum payments on the others. Once the first debt is paid off, add to the next one until all debts are paid off.

How can I start saving and investing for financial independence?

Start by setting aside a portion of your income for savings and investments. Look for low-cost investment options and diversify your portfolio to minimize risk.

Also, you can increase your income by creating and building various side hustles.

In a Nutshell

How to become financially independent is one of the important things to learn.

Without becoming financially independent, financial freedom becomes impossible.

That’s because financial independence leads to financial abundance.

Whether you’re setting financial goals or creating a budget, paying off debt, investing for the future, or creating multiple streams of income…

It will lead to your financial freedom, now and in the future.