5 Simple Ways to Become Debt Free & Create Abundance

Debt free. You might be thinking, “is it really possible to become debt free?”

Yes, and it’s more than just possible; it’s probable if you follow the steps outlined in this article.

Anyone can do it with the right tools and mindset.

In this article, you will discover 5 simple ways you can become debt free to be able to build and have more abundance.

Double Down to Become Debt Free

It’s discouraging to look at the debt you’ve accumulated or to get yet again another letter in the mail asking for a payment.

I know because I’ve been there.

Our society has taught the false notion that debt isn’t bad, everyone is in debt, it’s just part of life, and on and on. It’s preached at every corner.

I bought into that idea and paid for it bigtime.

The truth is you don’t have to be a slave to debt.

Though becoming debt free can be tough, it’s more possible than you realize… and can happen sooner than you could imagine.

You only need the right tools and strategy to tackle it with the certainty you WILL bring it down and make it disappear.

Compound Interest: Friend of Foe?

Something to consider is compound interest. Is it working for you or against you?

Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.”

When in debt, a person pays it.

That’s why it takes much longer to pay off a debt by simply paying the minimum payment. Interest is tacked on each month creating a larger bill than otherwise.

However, if you look at someone who is investing their money, they are earning interest and their investment grows over time due to compound interest.

Compound interest can be a friend or a foe depending on how you use it (or it uses you) and you should consider that when paying off debt.

Because of that, if you made one extra payment each year on your debt, you could beat it much faster.

For example, if you have a mortgage and pay one extra payment each year on it, you would cut the life of your mortgage down by seven years.

Seven years!

This leads us into another method for eliminating debt faster…

The Debt Snowball

The debt snowball speeds up the process of paying off debts.

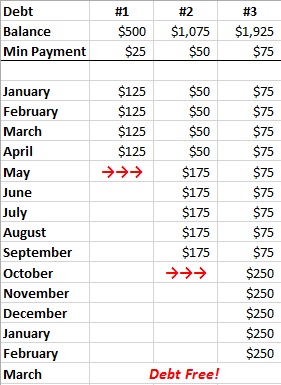

You put each of your debts in columns in Excel or Google Sheets with their minimum payments. Also, put each month listed down the first column.

Make sure you start with the most crucial debt first. For example, one that has the highest interest or one that is in collections.

Then put as much toward that debt each month as you can while still paying the minimum payments for the other debts.

As soon as that debt is paid off in full, add that amount toward the next debt on your sheet compounding the payments.

And as soon as the second debt is paid in full, add that amount toward the next debt until each of your debts are paid off and you are debt free.

You might look at this and say to yourself this doesn’t look fun. It’s not. Being in debt isn’t fun. It limits the choices you can make with regards to your money.

But being debt free is fun. It’s totally worth it.

Don’t Miss Payments

Missing payments is one of the worst things you can do when dealing with your debt.

That’s because the late fees add up fast and are usually pretty big.

I remember a time I fell behind on my payments and the fees added up so quickly and snuffed the life out of any hope of me paying it back. I tried.

You know what happened? The debt went to collections and I had a bigger problem on my hands.

Don’t miss payments!

Life happens however, and you might have to miss a payment or two. What then?

Go to your creditor and explain why you were late. Tell them it hasn’t happened before and it won’t happen again.

Many times they will reverse the late fees. Not always, but many times.

A lot of problems can be solved simply by communicating.

The same goes for debts in collections. Stay in communication with the collection agency and things work out better. I know this from my own experience.

Use Credit Wisely to Stay Debt Free

It’s been said that success happens when preparation meets opportunity.

As mentioned before, compound interest can be your friend.

But you have to understand how credit works in order to use compound interest to your advantage.

It’s not bad to use a credit card. They aren’t evil.

It’s also not bad to get a mortgage.

But to understand how to use these things wisely will make all the difference in the world for you and your financial present and future.

Let’s take credit cards, for example…

If you don’t have money and use a credit card, compound interest will work against you. It’s as simple as that.

The trick is to use a credit card when you have money then pay the credit card off each month before it accrues interest.

This does a few things:

- Builds your credit by establishing a good payment history

- Tells credit bureaus you can manage credit, which can then allow you to increase your credit limit

- Allows you to use other people’s money

- You avoid paying interest

It pays to pay it off each month.

If you’re in credit card debt, the best solution is to pay it of aggressively.

Make as many extra or higher payments as you can to get it paid off. Then, only use it when you have the money to pay it off each month.

Most people don’t rack up major credit card debt overnight. It’s a gradual process that happens over time. This is why it’s important not to use it unless you have the money to pay it off.

Live within Your Means

The obvious answer to taking care of debt is to avoid it in the first place.

It’s much easier to avoid it than to have to work hard to get it paid off. Here are some things you can do to start living within your means:

- Don’t get into debt to begin with and when you do, pay it off as soon as you can.

- Budget and track your expenses. This isn’t most people’s favorite thing to do, but if you don’t know your numbers, you can’t improve them.

- Cut up credit cards if you need to. It hurts, but it’s better than having debt to control your finances and peace of mind.

- Living within your means requires discipline, but it’s actually easier than you’d think.

- Shift your mindset. Think of money as a tool… as the means to an end, not the end itself. By understanding this, half the battle with finances is won.

Other Debt Free Strategies

There are other things you can do to become debt free faster. Here are a few ideas:

Earn Extra Income Through Side Hustles

Add more income to your household by starting a side hustle.

Some ideas are:

- Start a blog

- Write a book and sell it

- Start a YouTube channel

- Sell other people’s products (affiliate marketing)

- Learn a valuable skill then get the word out to get clients. This could be something like copywriting, website design, consulting, bookkeeping, tutoring, etc.

Having a side hustle gives you more money each month to work with to pay down your debt. Just be careful not to fall into the trap of using your credit card to build your side hustle. That would defeat its purpose and head you in the wrong financial direction.

Here’s a great article about blogging away debt.

Create Multiple Streams of Income

By adding a side hustle, you increase the amount of income you have available to pay down your debt faster. But what if you could multiply that extra income?

You do this by creating multiple streams of income. For example, if you have a YouTube channel, you can transcribe and reformat each video to put on a blog. Or if you do bookkeeping, you could also offer consulting on how businesses can save more money.

There are some ways you can create multiple streams of income. Not only will this give you more income, it will also give you a backup plan to protect you against any one of those income streams failing.

Negotiate with Creditors for Lower Interest Rates or Payment Plans

Call your credit card company and simply ask for a lower interest rate. Tell them there are a number of credit cards offering half the rate and would like yours lowered. See what they say.

The worst thing that could happen is they say no. But it’s worth a try because if they agree, you just saved yourself a lot of money in interest when you carry a balance on your credit card.

FAQ Section

Is there such a thing as good debt?

Yes, if it’s used to your advantage. For example, credit cards are a great use of debt if you pay them off regularly. Another example is a mortgage if it’s an amount that fits your budget and you can pay extra payments on it.

If I die, will my family have to pay my debt?

Yes and no. Sometimes. It really depends on the kind of debt.

Student loans are an example of debt that your family will have to take care of if you die. They don’t go away.

Other types of debt, like hospital bills, the family won’t have to worry about. But many debts will be paid off from the estate, which includes credit card debt.

Is it possible to still have fun while becoming debt free?

Not all fun has to cost money. Change things up a bit while you aggressively pay off your debts.

Instead of eating out, invite friends over for dinner at home. Go to the park to play with your kids instead of taking them bowling. Watch a movie at home with popcorn instead of going to the theater.

These changes in your entertainment are only temporary. And when you get back to going out after paying off your debt, you’ll enjoy the time out much more.

What if I can’t pay all my debt payments?

One strategy you can use is to pay a credit card payment and then use that credit card to pay some of your bills. This enables you to use the money for your bills to pay your credit card bill. You can do that for more than one credit card.

It can seem a little messy though, so be sure to keep track of everything.

You want to get to the point where you can start paying more on it to pay it down. This will bring your interest charges down and lead you in the direction of eventually paying it off.

In a Nutshell

There are various things you can do to tackle the burden of debt and take back control of your finances.

Double down to become debt free. Do everything you can to get rid of it. Use the debt snowball or other methods to pay it off quicker.

Only then will you have peace of mind. Imagine laying your head on your pillow at night without a thought of debt…because it’s GONE. That feeling is beyond almost any other.

You want more out of life? Get rid of the burden of debt, once and for all.